Of all the other fields in the world these days, the finance world seems to be one that’s growing steadily. That’s the reason why if you are looking for a better career; take one of those finance related works. For instance, after graduating from any bachelor’s degree course, you can get certification financial planner. Financial planner certification is one promising job that would really make you land on a higher position and of course get a higher pay. But the entire process of getting the certification isn’t a walk in the park. It’s hard and there’s a reason why.

The certified financial planner board of standards makes sure that the CFP they produce are of high quality, equipped with values and more importantly developed ethics that are beneficial to any client or employer. So how can a person be a certified financial planner? First is that as we have mentioned earlier, he or she should be a graduate of any bachelor’s degree course or even higher. While any kind of course can be considered, it’s recommended that you have a degree in finance and business courses like accountancy. With this, you are presumed to already have ample knowledge on how the market works as well as other key terms in the finance industry.

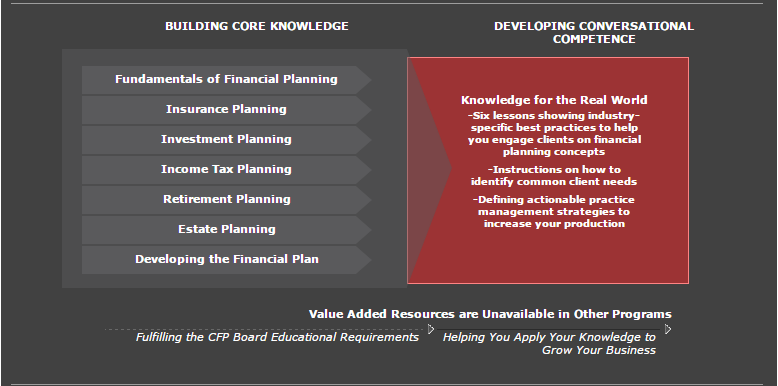

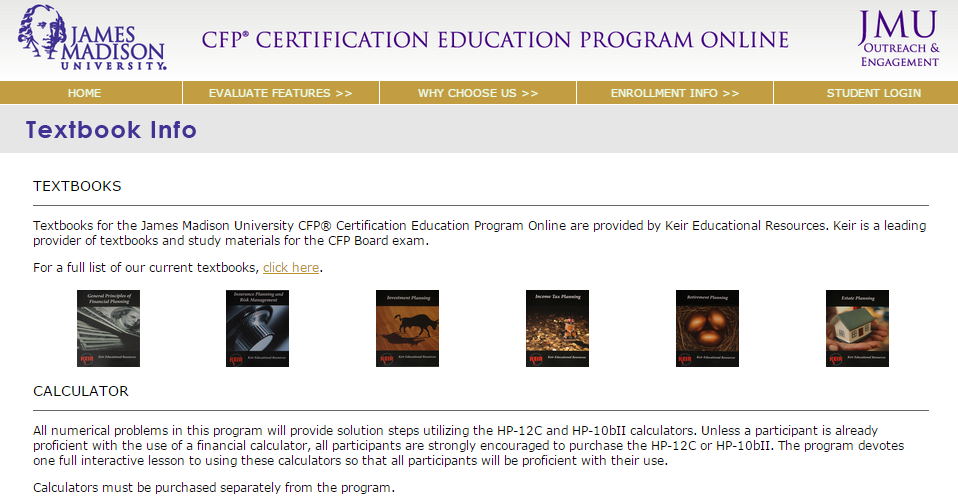

Once you have completed the requirements, you can now start looking for an accredited financial planning school. For around 6 to 8 months, you will have to undergo classes that cover the principles of financial planning. The style of teaching varies depending on the schools that provide these courses but all the same, the topics are being regulated by the certified financial planner board of standards. Therefore, regardless of where you are, as long as the business school you are into is accredited by the said board of standards, you’ll receive the information that you ought to learn.

Now, not all of you might have the luxury to go into actual schools and these institutions are aware of this. To solve this matter, there are financial schools that offer online CFP courses for those who are not able to go to class rooms because of schedules and other conflicts. Yes, with the help of the internet you’ll be able to receive the same learning from the best mentors and eventually get through the next stage of your certification financial planner process.

The final step is to take the certified financial planner examination. It’s a 10 hour rigorous test that will try out your skills in analyzing problems pertaining to financial planning. You simply have to try your best to pass this and once the results come in, you can already get your certification. You just have to follow the mandate of the board of standards for your continuing education. That’s it and you’re ready to face a new chapter of your life.

The article is all about how to pass and ge certification financial planner. It’s important that you get these designations to show how much you’ve learned and how skillful you are in that particular field of finance. Learn more about financial planner certification now.

The certified financial planner board of standards makes sure that the CFP they produce are of high quality, equipped with values and more importantly developed ethics that are beneficial to any client or employer. So how can a person be a certified financial planner? First is that as we have mentioned earlier, he or she should be a graduate of any bachelor’s degree course or even higher. While any kind of course can be considered, it’s recommended that you have a degree in finance and business courses like accountancy. With this, you are presumed to already have ample knowledge on how the market works as well as other key terms in the finance industry.

Once you have completed the requirements, you can now start looking for an accredited financial planning school. For around 6 to 8 months, you will have to undergo classes that cover the principles of financial planning. The style of teaching varies depending on the schools that provide these courses but all the same, the topics are being regulated by the certified financial planner board of standards. Therefore, regardless of where you are, as long as the business school you are into is accredited by the said board of standards, you’ll receive the information that you ought to learn.

Now, not all of you might have the luxury to go into actual schools and these institutions are aware of this. To solve this matter, there are financial schools that offer online CFP courses for those who are not able to go to class rooms because of schedules and other conflicts. Yes, with the help of the internet you’ll be able to receive the same learning from the best mentors and eventually get through the next stage of your certification financial planner process.

The final step is to take the certified financial planner examination. It’s a 10 hour rigorous test that will try out your skills in analyzing problems pertaining to financial planning. You simply have to try your best to pass this and once the results come in, you can already get your certification. You just have to follow the mandate of the board of standards for your continuing education. That’s it and you’re ready to face a new chapter of your life.

The article is all about how to pass and ge certification financial planner. It’s important that you get these designations to show how much you’ve learned and how skillful you are in that particular field of finance. Learn more about financial planner certification now.